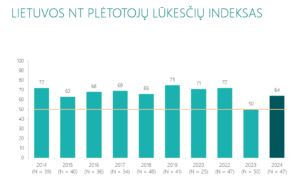

Lithuanian Real Estate (RE) Developers Are Optimistic About the Sector’s Growth in 2024

The 2024 Real Estate Market Expectations Index indicates that Lithuanian real estate developers are quite positive about the sector’s development. The index value, calculated on a scale of 0 to 100, is 64 points for this year. This means that a more active real estate market with increasing workloads and capacities is expected this year. It is noteworthy that the sentiment of real estate developers this year is very similar to that of 2015. Compared to 2023, when the lowest index value in the entire calculation period was recorded, the expectation indicators have increased by 14 points in 2024. The Expectations Index has been calculated since 2014.

“The improving sentiment of real estate developers is encouraging and shows a cautious belief that the sector will gradually gain momentum this year. Despite more positive expectations for workloads and growing capacities, the sector still assesses the future prospects moderately, without exceeding the limits of moderation. However, most of the Expectations Index indicators show that real estate market participants see more opportunities than obstacles,” says Mindaugas Statulevičius, President of the Lithuanian Real Estate Development Association (LNTPA), presenting this year’s Expectations Index at the annual Lithuanian Real Estate Conference CORE.

Chart No. 1. Real Estate Expectations Index 2024

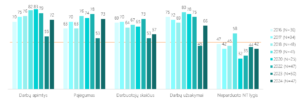

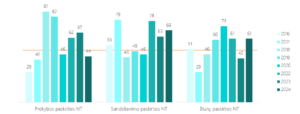

Strong growth is seen in workloads (72; was 55 in 2023) and capacities (73; was 53), and the order book indicator also rose relatively high (66; was 45). The unsold RE level indicator decreased slightly (42; was 44).

Chart No. 2. Real Estate Expectations Index Components

Assessing the financial aspects of the expectations index, a moderate but faster-than-previous-years increase in employee wages is forecasted (79; was 73), along with a higher need for corporate borrowing (69; was 62). Demand for jobs in the domestic market has emerged from recession into growth, reaching a indicator of 58 (was 35). No changes are predicted in raw material prices for this year (45; was 47).

Chart No. 3. Financial Components of the Real Estate Expectations Index

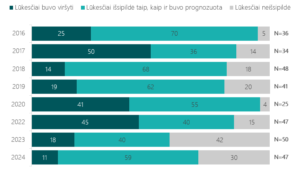

According to 11 percent of surveyed companies, the expectations for the past year were exceeded, and more than half (59) of the companies claim that the expectations were fulfilled as forecasted. However, 30 percent of surveyed real estate developers state that their expectations for 2023 were not met.

In assessing the factors influencing last year’s performance, respondents most frequently cited the increase in EURIBOR interest rates (57) as the primary factor, followed by residents’ expectations (34), and the economic situation in the country (26 ).

Chart No. 4. EVALUATION OF EXPECTATIONS FOR THE PREVIOUS YEAR (PERCENT)

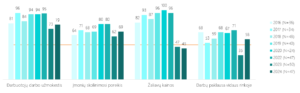

According to half (49 percent) of the respondents, the biggest incentives for real estate development in 2024 will be driven by increased borrowing, with less emphasis on improving the economic situation (17 percent) and the existing level of real estate supply (11 percent).

“When it comes to obstacles to the real estate market’s expansion in 2024, it is regrettable to note that respondents most frequently cited bureaucratic hurdles, an unfavorable legal framework, and the cumbersome implementation of new regulations. This indicates that the smooth development of the real estate sector is most hindered by subjective factors artificially created within the state, rather than objective external factors such as geopolitics or the global economic situation,” says M. Statulevičius, the head of LNTPA.

Bureaucratic processes and inadequate legislation are identified by 34 percent of respondents as the most detrimental obstacles to smooth sector development, while 23 percent point to uncertainty about the war in Ukraine.

In 2024, the majority (51 percent) of real estate developers plan to invest more than 10 million euros in residential projects, while those surveyed are most inclined to invest 5-15 million euros (27 percent) or not foresee any such investments (27 percent) in commercial projects.

“We see that the ranks of real estate developers planning to invest more than 10 million euros in the housing segment have grown. If last year we had 35 percent, this year it’s 51 percent. However, it should be noted that the number of builders who do not plan any investments in the residential real estate sector has increased: from 12 percent in 2023 to 20 percent this year,” comments the head of LNTPA.

The absolute majority (87 percent) of real estate developers plan to develop new projects in Vilnius in 2024. In Kaunas and Klaipėda, 15 percent of surveyed companies each intend to do so, while in Šiauliai, it is 7 percent.

A moderate growth is expected in the residential real estate market in 2024 – the development index for residential units reaches 62 (was 52), and the overall residential development index for this year is 57 (was 51).

Grafikas Nr. 5 PATRAUKLAUS BŪSTO CHARAKTERISTIKOS 2024 M. (PROC.)

“As we can see, there is a lack of emphasis on housing layout, energy class, maintenance costs, and parking criteria influencing residents’ choices of where to live. However, we observe a significantly increased demand for well-developed and convenient infrastructure: kindergartens, schools, connectivity, etc. The competence of real estate developers and construction quality also becomes important. This is a positive trend because residents demanding quality encourage the professionalism and responsibility of market participants,” summarizes M. Statulevičius, the head of LNTPA.

69 percent of surveyed residential project developers are preparing to sell up to 20 percent of housing for investment in 2024, while 17 percent will sell 20-40 percent of housing.

Chart No. 6 COMMERCIAL REAL ESTATE PROSPECTS

In 2024, moderate growth is anticipated in commercial real estate: there will be an increase in the development of warehouse projects (index 69, compared to 63) and office projects (61; was 42). The retail real estate market is expected to experience stagnation (44; was 67).

About the Real Estate Developers’ Expectations Index in Lithuania

The Real Estate Developers’ Expectations Index in Lithuania is calculated by the Lithuanian Real Estate Development Association (LNTPA) as an advance macroeconomic indicator, allowing for the prediction of the state of the Lithuanian real estate developers’ market for the upcoming year. The LNTPA calculates the Real Estate Developers’ Expectations Index, enabling the anticipation of perspectives in this sector for the coming years and forecasting real estate prices. The real estate market is traditionally closely related to overall market expectations and is significant in assessing the state of the entire economy.

The index is calculated according to the Markit Economics standard, supplemented with relevant questions specific to the Lithuanian real estate market.

The index has been calculated since 2014, and survey participants are leaders or development managers of real estate companies. The index values can range from 0 to 100 points. If it is less than 40 points, a recession in the real estate market can be expected in the near future. If the index value fluctuates between 40 and 50 points, it can be stated that there is uncertainty prevailing in the real estate sector, and market stagnation can be expected in the coming years. An index value exceeding the 50-point threshold indicates that there will be growth trends in the real estate market in the near future, contributing to the overall economic growth of Lithuania.

The survey for 2024 was conducted in January-February by SPINTER research on behalf of LNTPA and the company “Ober-Haus nekilnojamas turtas.” A total of 47 major Lithuanian real estate developers were surveyed.